An old quote — “the more things change, the more they remain the same” — came to mind as I exited yet another conference on the strategic challenges reshaping the utility industry.

One much-discussed challenge was the changeover of the generation fleet, from coal to gas and renewables. That one’s way above most of our pay grades.

Something that’s a lot closer to our sphere of influence, though, is customer behavior. The separate but related challenges of rooftop solar, battery storage, net metering and learning thermostats all point to flat or negative load growth in the near term and potentially significant changes in the utility-customer relationship over the long term.

A Utility Brand is a Bundle of Attributes

But like the start of retail competition more than two decades ago, the current challenges can be managed effectively if an electric utility or electric cooperative has a brand that is trusted by its customers or members.

That’s as true today as it was two decades ago, when California, Texas and Pennsylvania began introducing retail electric competition. If you don’t give your customers a reason to investigate alternatives, most of them won’t. If you do, more of them will.

Customer trust also can shorten the time it takes a utility to recover from a crisis, a scandal or a shortfall.

Marketing professionals define a utility’s brand as a bundle of attributes that are meaningful to its target audience. Years ago, in a report written for E source, I interviewed a utility executive who was a little fuzzy about his company’s brand. First he confused branding with advertising, and then he said, “We just changed our logo. Isn’t that the same thing?” I expect we all have come a long way since then.

Market Strategies International (MSI) has been measuring the trustworthiness of utility brands for several years. Earlier this year it released Utility Trusted Brand & Customer Engagement™: Residential, a syndicated Cogent Reports™ study. The study looked at three areas — service satisfaction, product experience and brand trust — that roll up to the firm’s proprietary metric: Engaged Customer Relationship.

Communications Critical to Establishing, Strengthening Utility Brand

Although the MSI Cogent study differs in fundamental ways from the J.D. Power & Associates customer satisfaction studies, I was drawn to one of their similarities: the importance of communications.

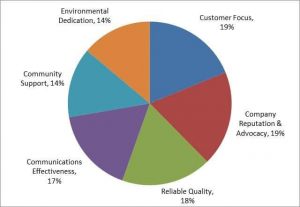

Here’s a high-level depiction of the MSI Cogent customer engagement model:

And here’s a deeper dive into the MSI Cogent model’s weightings for brand trust:

Utilities’ communications scores in the MSI Cogent model are based on things like customer perceptions of the usefulness of information provided, accuracy, tone and communicating via customer-preferred channels. The model’s weighting — and correlations between Communications and other brand trust factor scores — show that excellence in customer communications significantly influences positive brand perceptions.

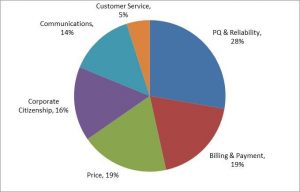

By contrast, here’s the J.D. Power model for residential electric customer satisfaction.

Communications Tip of the Month: Communications is a valuable activity in itself, but it also can help cushion utilities against dramatic shifts in their business. In that way, communications is a strategic risk-management activity.

Communications Influence Other Performance Metrics

The MSI Cogent and J.D. Power studies show “communications” is one specific performance category, but communications also is a factor in other metrics. For the MSI Cogent study, communications effectiveness affects customer focus, company reputation, community support and environmental dedication.

For the J.D. Power study, communications colors customers’ perception of prices and corporate citizenship. J.D. Power’s study shows how communications can improve transactional satisfaction.

For either study, then, when you combine the specific performance category of “communications” with the other categories that are affected by communications, you can see the importance of communications in both the MSI Cogent study and the J.D. Power residential electric customer satisfaction survey. Communications has a halo effect on both brand and satisfaction that makes it an extremely important touchpoint to influence customer scoring.

Since the J.D. Power studies regularly garner their fair share of ink, I thought I’d discuss the MSI Cogent model with K.C. Boyce, Senior Product Director at Market Strategies International (left).

“Customer satisfaction is basic table stakes,” he said in an interview. “You don’t get any kudos if you do it well. But if you don’t do it well, you do get dinged.”

“We wanted to go beyond CSAT to look at the emotional attachment customers have to their utilities,” he continued.

A Utility Brand is Your Safety Net — Does Yours Have Holes?

“In a turbulent environment, brand trust is more important that customer satisfaction,” K.C. said. “Emotional attachment leads to brand affinity and willingness to recommend to others. It also offers better protection from the threat of substitutes like rooftop solar, electricity storage and so on. Those challenges are nibbling at the edge of the utility business model today, but we expect they will rise in importance over time.”

A growing number of utilities are starting to take the concept of a brand more seriously, he commented: “They are becoming more comfortable with the idea of a brand and they are starting to invest in brand-building activities.”

Market Strategies International has several dozen utility subscribers to its brand research, including Georgia Power, New Jersey Natural Gas, South Carolina Electric & Gas (SCE&G) and Duke Energy, among others.

A couple of current high-profile challenges illustrate the importance of being a trusted utility brand:

- SCE&G and Santee Cooper are going through a complicated crisis relating to their decision to terminate construction of two new units at the Virgil C. Summer nuclear power plant after spending billions of dollars to build those two units.

- Georgia Power faces a nuclear challenge of its own: its determination to complete construction of two new nuclear units at the Alvin W. Vogtle nuclear power station, despite those units being billions of dollars over budget and years behind schedule.

Although state regulators ultimately will decide whether and how rapidly those utilities recover from their respective controversies, customer trust also plays a role. Think of trust as a safety net that breaks a utility’s fall when something goes wrong.

Does your utility’s safety net have holes in it? The best way to begin closing those gaps is to communicate more often, more honestly and more effectively with customers, employees and other stakeholders.

In a press release, Boyce’s colleague, Chris Oberle, an MSI senior vice president, had this to say about the importance of having a trusted utility brand:

Building a brand that customers trust and offering products and services customers will use are the new utility challenges. Brand trust is truly the difference between customers supporting or resisting new utility income opportunities.

Our research clearly shows utility brand trust levels are closely tied to financial success, customer advocacy and market support for rate changes. High brand trust benefits customers, shareholders and stakeholders, and positions utilities as credible players in shaping the evolving utility market.

He noted high brand trust scores are required if utilities hope to attract customer use of alternative energy offerings and to increase the preference to use utilities as providers of these products. Additionally, customers who trust their utility are twice as likely to recommend those alternative energy products to other customers.

As with most things in life, the only way to become a trusted partner is to communicate early, often and effectively. The more things change …