iStock

Denial, the old saying goes, ain’t just a river in Egypt.

That rattling sound you hear when you drive your car? Ignore it — maybe it will go away. That pain in your back? Probably caused by sleeping in an awkward position last night. Feeling sluggish? Grab another cup of coffee.

Sometimes it’s nothing, but other times we may be whistling past the graveyard.

So many of us swim in the river of denial that it was delightful to hear David Osburn, general manager of the Oklahoma Municipal Power Authority (OMPA), talk about how his organization used market research to detect, and respond to, rising customer disaffection.

Customer Satisfaction: Don’t Wait for a Crisis!

Osburn spoke last summer at the American Public Power Association (APPA) National Conference. His advice is timeless and timely for all energy companies, public and private. Invest time and effort to stay abreast of your customers’ views and expectations, and then act on what the data tells you. The life you save may be your organization’s!

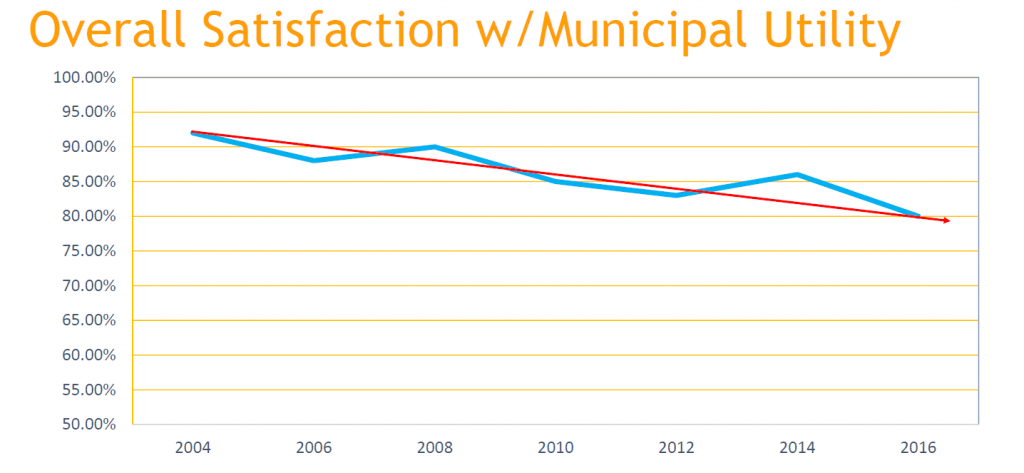

OMPA is a joint action agency (JAA) providing wholesale power to 42 Oklahoma locally owned energy companies. Osburn explained that OMPA launched its “Our Local Power” campaign in September 2018 after what he said were “less than desirable results” on retail customer satisfaction surveys and declining overall satisfaction (see chart below).

Osburn said that OMPA’s finding echoed primary market research conducted by APPA: that most customers of publicly owned electric companies did not know they were being served by a publicly owned electric company and why that made a difference.

To close this information gap, which could pose significant perils to OMPA and its members, the organization began where it should: By more actively and consistently communicating, alongside its members, what OMPA is and how customers benefit from it.

That’s why market research exists: to uncover unmet needs and identify potential risks. Market research then leads to messages crafted by communicators and marketers for their campaigns. By identifying potential points of friction with customers, and then working to remove them, market research helps an organization run better.

Periodically, Osburn noted, there have been calls in Oklahoma for locally owned electric companies to sell themselves to shareholder-owned energy companies. Electric system ownership became the focus of recent elections in that state. City councils, perennially facing budget shortfalls, sometimes consider selling a municipal electric company to generate cash and remove debt from the city’s balance sheet.

Short-term thinking like that can take hold pretty quickly if the energy company has not been communicating the value of local ownership on a continual basis. That issue periodically rears its head in Colorado Springs, Colorado, among other places. It was the driving force in Vero Beach’s (Florida) decision to privatize and in JEA’s (also Florida) decision last year to investigate privatizing, which it eventually decided against.

Small ongoing investments can forestall a potentially significant jolt down the road. “Take care of business,” Osburn said. “Don’t give someone a reason to sell!”

Osburn appeared on a panel with Jeffrey Stewart, the interim general manager of Lafayette Utilities System (LUS), which had recently beaten back a privatization effort. Because LUS’ experience has drawn wide attention among locally owned energy companies, I have blogged about it here and here.

Credit: OMPAGolden Rule Applies to All Energy Companies

Although the OMPA chief was speaking to peer locally owned energy companies, Osburn’s points apply equally to energy companies that are owned by stockholders.

Many stockholder-owned energy companies have traditionally viewed investors as the “first among equals” compared to other stakeholder groups. I have seen evidence that those companies are gradually recognizing the need to do a better job investing in and rewarding their other stakeholders, including customers, employees and communities.

Yes, companies with investors need to reward those investors. After all, they own the company and they expect to earn a return. But balancing the needs of different stakeholder groups — stockholders, regulators, customers, employees and communities — can quickly go off the rails because one group — stockholders — typically cares only about a company’s dividends and stock price. They care little for non-financial items like customer satisfaction, employee development and community reinvestment.

Given the short-term focus of many institutional investors, I wonder about the wisdom of bending over backwards to disproportionately reward that group ahead of other stakeholder groups. Institutional investors, who tend to own most of an energy company’s stock, are the quintessential “here today, gone tomorrow” crowd. “What have you done for me lately?” is their continual refrain. They won’t hesitate to dump your company’s stock when it fails to meet (or even exceed) earnings. And if someone is willing to pay a premium, even a small one, to acquire that company, more often than not they’ll take the money and run.

So why unduly reward a constituency that has such a narrow and one-dimensional interest in your company?

Communications Tip: Energy organizations, public and private, can keep the proverbial wolf away from their door if they continually communicate with all of their stakeholders about how each of them benefits in different ways from the company’s actions. Tell more stories. Keep it short and simple. Sacrifice precision for narrative impact.

There will come a time when you need support from your stakeholders. At that moment, the truth of the Biblical adage — as you sow, so shall you reap —will become self-evident.

——————————————————–